- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

The world of cryptocurrency trading is a high-risk, high-reward battlefield that never sleeps. One wrong move and you could find yourself flat-footed and losing your hard-earned money.

This is why it is essential to have a well-planned trading strategy that works for you.

One key aspect of effective management that not a lot of us realize, is that if you want to invest safely and at a high return rate, you MUST have multiple crypto accounts.

In this article, we will explore why it is so important in the year 2023, and how you can safely create multiple crypto accounts without any risk.

Although the strategy tells you to have 2 crypto accounts, you do not put these 2 accounts in the same position.

They are for different purposes.

One of the 2 accounts is a long-term account.

A long-term account is for investors who believe in the long-term potential of cryptocurrencies. You buy and hold it for years or even decades, and you use it for low-leverage shorts.

The low-leverage shorts strategy is a conservative approach that reduces the risk of significant losses. When using this approach, you have to be patient and understand that cryptocurrency prices can be volatile in the short term but will eventually trend upwards in the long term.

The other one of the 2 accounts is a short-term account or a “scalping account”.

A scalping account is for short-term trades. This account is for investors who want to make quick profits by buying and selling cryptocurrencies over a short period, usually within a day or a few hours.

“Scalping” is a high-risk, high-reward strategy that requires investors to have a good understanding of the market and be able to react quickly to market movements. When you use this approach, you tend to use high-leverage shorts, which means that you may need more money to invest in cryptocurrencies, increasing your potential profits but also your risk of significant losses.

So the core of this strategy is to have both a long-term account and a short-term scalping account at the same time.

The long-term account was for low-leverage trades and shorts, while the scalping account was for short-term trades.

By doing so, you can balance your risk and maximize your profits. By having a long-term account, you can take advantage of the long-term potential of cryptocurrencies while minimizing your risk. On the other hand, with a short-term scalping account, you can take advantage of short-term market movements and potentially make quick profits in short term.

A bonus of this strategy is that you can also use profits from your scalping account to reinvest in your long-term account, further maximizing your profits.

Although the 2-account strategy in cryptocurrency is a smart move, it is not so easy to be applied. One of the most challenging difficulties is platform restriction.

Many cryptocurrency exchanges have strict rules and regulations that limit the number of accounts a user can create. This is reasonable because the platforms need to prevent users from abusing the platform and engaging in fraudulent activities, such as money laundering or market manipulation.

Therefore, they have implemented measures to prevent users from creating multiple accounts. For example, popular exchanges like Binance and Coinbase have strict rules regarding multiple accounts. Binance states in its terms of service that "users shall not register or operate multiple Binance accounts at the same time, or use or assist others to use Binance accounts for the purpose of money laundering or other illegal activities."

Similarly, Coinbase also prohibits users from creating multiple accounts, stating that "you may only create and hold one account on the Coinbase platform.”

Such restrictions are in place to ensure the integrity and security of the exchange and to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Although the rules seem to be tough, there are still methods that allow you to work your way around the restrictions and implement the multiple crypto account strategy.

The key to a successful multi-account crypto strategy is to create each account with different digital fingerprints so the exchange won’t identify these accounts as being run by yourself.

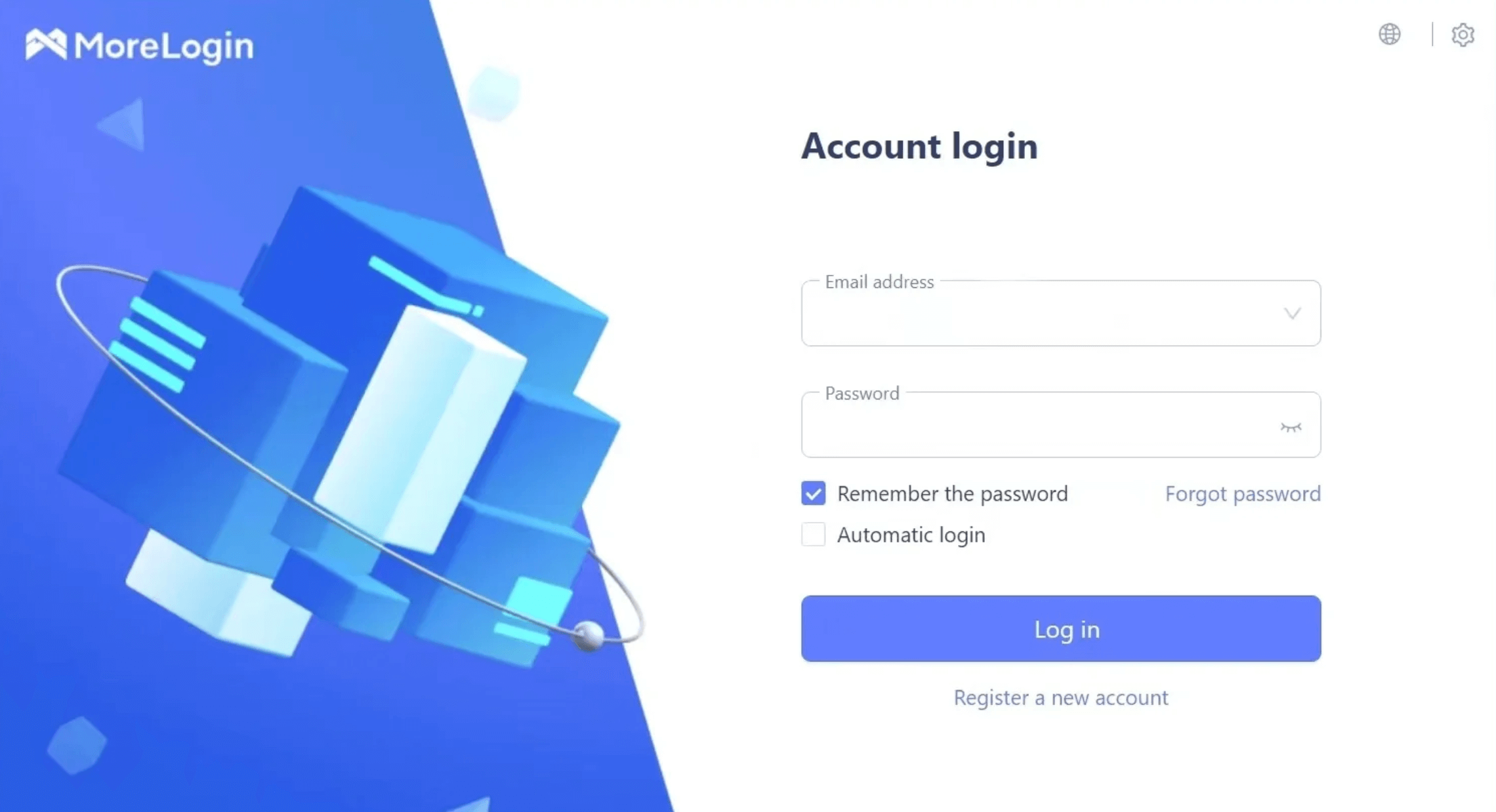

One of the most reliable ways to do that is to use an anti-detect browser like MoreLogin.

Using an anti-detect browser can help bypass the strict rules and regulations imposed by cryptocurrency exchanges with no risk as all your identity is masked and isolated by the browser.

In case you haven’t heard of this before, an anti-detect browser is a type of web browser that helps protect your privacy by masking your online activity, making it more difficult for websites to track and identify you. These browsers use advanced techniques such as changing IP addresses, browser fingerprints, and other identifying information to create a unique profile that is difficult to trace.

MoreLogin, as an example of an anti-detect browser, allows users to manage multiple accounts on not only crypto markets, but also multiple accounts on social media platforms like Facebook, Tiktok, and more.

The browser provides a secure environment for multiple account management on a single device, and it also features the ability to customize profile elements according to demands. By creating multiple browser fingerprints, MoreLogin can prevent crypto markets from identifying accounts used on the same device and limiting activities.

One of the most unique features that MoreLogin has is the virtual environment, which can provide a customizable browser fingerprint that masks the configuration to look like a real device.

By using an anti-detect browser, you can create multiple crypto accounts without being detected by the exchange.

With an anti-detect browser, you can easily create 2 or even more crypto accounts and implement the advanced strategy.

But that’s just the beginning.

To make sure you actually benefit from cryptocurrency, you need to apply different mindsets and sub-strategies to both of your accounts.

For the long-term crypto account, remember to follow the market trends closely and make informed investment decisions. You have to watch for any news or developments that could impact the cryptocurrency market, and keep your emotions in check to avoid making decisions based on emotions. You should never panic and sell during a market dip, or get too excited and buy during a hype. Stick to your investment plan and stay disciplined.

On the other hand, for the short-term account, you need to actively use technical analysis. Scalping is all about short-term trading, so it's important to use technical analysis to identify trends and patterns in the market.

Additionally, setting stop-losses is also important. Scalping involves taking quick profits, but it's also important to protect your investments. Set stop-losses to limit your losses if a trade doesn't go as planned so that your return rate can always stay high, and your risk of losing a ton of money can be as low as possible.

In a word, a successful crypto investor needs to have patience, discipline, and a willingness to learn and adapt their strategy as the market changes. With the right mindset and strategy, coupled with multiple accounts and an anti-detect browser, you can set yourself up for success in the crypto market.

In conclusion, having both a long-term investment account and a short-term scalping account can be a smart strategy for navigating the unpredictable world of cryptocurrency. However, it's important to note that creating multiple accounts can be challenging due to security concerns and potential restrictions from exchanges.

That's why using an anti-detect browser like MoreLogin can be an essential tool for implementing this strategy safely and effectively.

With the ability to switch between multiple accounts seamlessly, you can take advantage of both long-term gains and short-term opportunities without putting your investments at risk. So if you're serious about crypto trading, consider utilizing the power of multiple accounts with the help of MoreLogin.